Filed Under: News with 0 Comments

Filed Under: News with 0 Comments

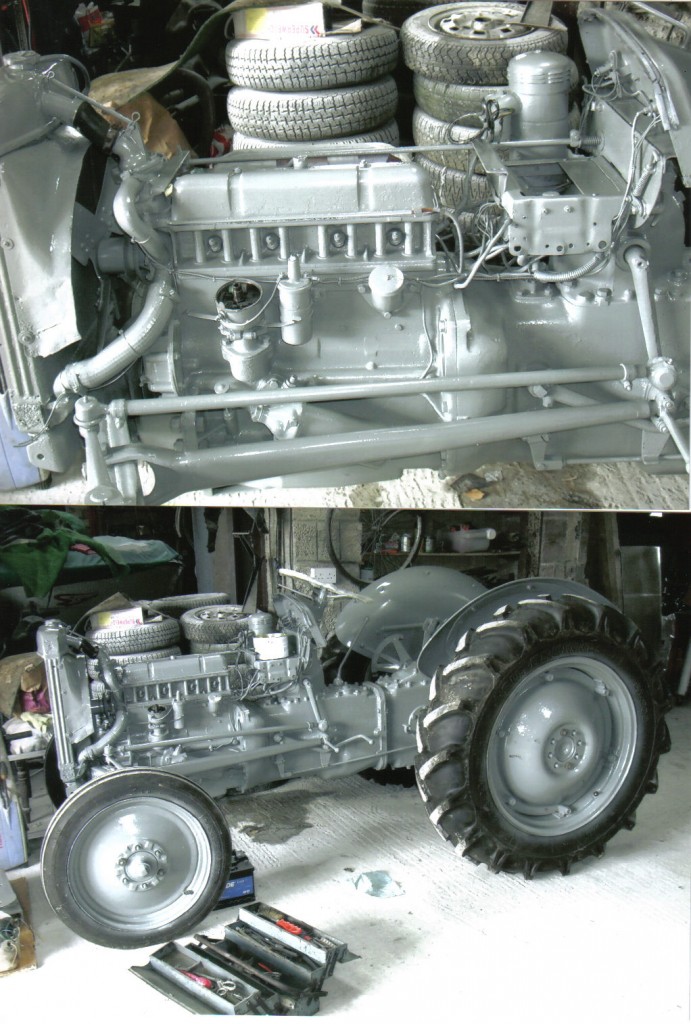

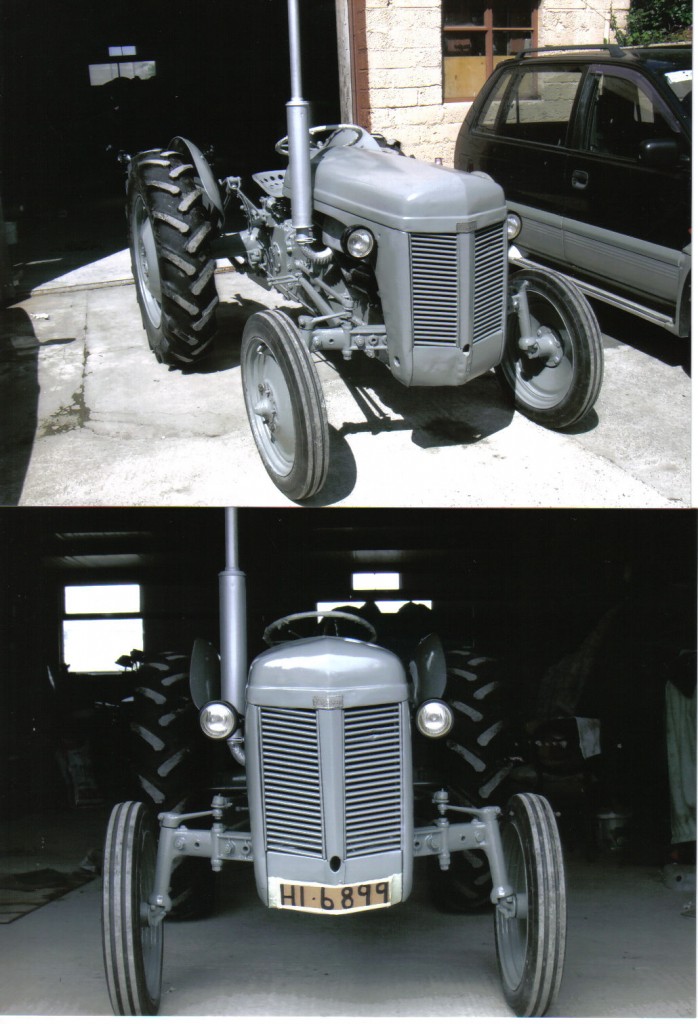

SUCCESSFUL MEETING IN WOODS WITH A GOOD CROWD AND THE SURPRISE OF BURGERS AND HOT DOGS THANKS TO EAMON FOLEY. ALSO A SURPRISE THAT OUR CHAIRMAN DID NOT KNOW ABOUT THE ARRIVAL OF THE FERGUSON TRACTOR THAT IS NOW READY FOR OUR “CLUB MEMBERS DRAW” WHICH WILL BE HAPPENING LATER IN THE YEAR

Filed Under: News with 0 Comments

YE WILL BE GLAD TO KNOW THAT THE “ CLUB MEMBERS RAFFLE” TRACTOR IS READY

BEST OF LUCK TO THE WINNER WHOEVER HE/SHE MIGHT BE

BEST OF LUCK TO THE WINNER WHOEVER HE/SHE MIGHT BE

Filed Under: News with 0 Comments

Filed Under: News with 0 Comments

Vehicle Registration Tax (VRT) is based on the Open Market Selling Price (OMSP) of the vehicle. The OMSP depends on the market value, engine size, year, model and roadworthiness condition of the vehicle.

After the vehicle has been inspected the rate of VRT is calculated by Revenue. The VRT is collected by the NCTS on behalf of Revenue. You can pay by bank draft (payable to NCTS), Laser (debit) card or credit card. If you are using a Laser debit card to pay, the transaction is limited to €1,500 per day. If the VRT payment exceeds this amount, you can pay the balance by bank draft.

Since 1 July 2008 VRT for cars (Category A) is no longer based on engine size but on the level of CO2 emissions from the car. On the Sustainable Energy Authority of Ireland’s (SEAI) website you can check the CO2 emissions levels for different car models.

VRT rates for Category A vehicles from 1 July 2008

| CO2 emissions levels | VRT rates | |

| Band A | under 120 grams per kilometre | 14% of OMSP (minimum €280) |

| Band B | 121 – 140 grams per kilometre | 16% of OMSP (minimum €320) |

| Band C | 141 – 155 grams per kilometre | 20% of OMSP (minimum €400) |

| Band D | 156 – 170 grams per kilometre | 24% of OMSP (minimum €480) |

| Band E | 171 – 190 grams per kilometre | 28% of OMSP (minimum €560) |

| Band F | 191 – 225 grams per kilometre | 32% of OMSP (minimum €640) |

| Band G | over 225 grams per kilometre | 36% of OMSP (minimum €720) |

Vehicle Registration Tax rates for all other categories

| Category | Vehicle | VRT rate |

| B | Car derived and jeep derived vans | 13.3% of OMSP (subject to a minimum tax of €125) (Since 1 January 2011, light commercial vehicles previously charged at the Category C rate have been charged at the Category B rate) |

| C | Other vehicles such as tractors, large vans, lorries, vintage cars (over 30 years old), minibuses (minimum 12 passenger seats) | From 1 May 2011 flat rate of €200 (was €50). |

| Motor caravans/motor homes | 13.3% of OMSP since January 2011 | |

| Motorcycles (new) | €2 per cc up to 350cc and €1 per cc thereafter | |

| Motorcycles (used) | As for new. Total amount is then reduced by percentage depending on age (over 30 years 100% reduction) | |

| Hybrid electric vehicles and flexible fuel vehicles* | VRT relief of up to €2,500 depending on the age of the car in respect of certain series production vehicles until 31 December 2010. This scheme is being extended until 31 December 2012 with VRT relief of up to €1,500. | |

| Plug-in hybrid electric vehicles** | VRT relief of up to €2,500 depending on the age of the car in respect of certain series production vehicles until 31 December 2012 | |

| Electric vehicles and electric motorcycles*** | Exempt from VRT until 31 December 2012 |

*A hybrid electric vehicle derives its power from a combination of an electric motor and an internal combustion engine and is capable of being driven on electronic propulsion alone for a material part of its normal driving cycle. A flexible fuel vehicle has an engine capable of using a blend of ethanol (minimum 80%) and petrol.

**A plug-in hybrid electric vehicle derives its motive power from a combination of an electric motor and an internal combustion engine, where the electric motor derives its power from a battery that may be charged from the internal combustion engine and an alternating current (AC) electric mains supply and is capable of being driven on electric propulsion alone for a material part of its normal driving cycle.

***An electric vehicle/motorcycle is propelled by an electric motor only.

In order to register and pay the VRT you must bring your car for an inspection to your local designated NCTS centre (there are 22 of these around the country). You must book an appointment with the NCTS within 7 days of your car’s arrival into Ireland. There is detailed information about the registration process on the NCTS website. At the inspection you must bring a completed Declaration for Registration for a New or Used Vehicle/Motorcycle (pdf) and present it with the following documents:

If you are registeringa new vehicle (less than 3 months old or travelled less than 3,000km) you must also bring an EU Whole Vehicle Type-Approval Certificate of Conformity or IVA NASSTA Certificate of Conformity. (This document will be retained by NCTS so you should keep a copy of it)

If you are registeringa used vehicle (over 3 months or 3,000km) you must also bring evidence of previous registration such as foreign certificate of registration, a certificate of permanent exportation or a certificate of de-registration. (This document will be retained by NCTS so you should keep a copy of it)

If you are claiming an exemption from VRT, you must bring the exemption certificate issued by Revenue

When enquiring about VRT rates, you need to provide specific information about your vehicle. The Revenue Commissioners have also produced a guide to VRT which is a list of frequently asked questions about VRT in Ireland. They have also produced a guide to the CO2-based VRT for cars.

VAT

If you are importing a new car from another EU country VAT is payable in addition to VRT – see ‘VAT’ above. You pay this when you register the car. If you are importing a new or secondhand car from outside the EU, VAT and customs duty is payable. Customs duty is paid when the vehicle first enters the EU, at the point of entry. You must have proof of payment of this when you are registering the car in Ireland.

If you have a question relating to this topic you can contact the Citizens Information Phone Service on lo-call 1890 777 121* or on +353 (0) 21 452 1600 (Monday to Friday, 9am to 9pm) or you can visit your local Citizens Information Centre. *Please note that the rates charged for the use of 1890 numbers may vary among different service providers.

Filed Under: News with 0 Comments

Filed Under: News with 0 Comments

We are pleased to announce that Danesfort field day has now also become the National Rally for the “IRISH MORRIS MINORS CLUB ” We are very happy to have them on board as the “Morris Minor” is our feature car for this event . With” 9 ” weeks to go ,the pressure is on the get all things ready and get our Morris Minor’s in order

The Irish Morris Minor Owners Club was founded in 1982. Our aims are simply to promote the preservation and use of the Morris Minor.

The IMMOC exists for people who have a Morris Minor, those who have an interest in Morris Minors and those people who use them every day. It is for people to get together and enjoy their Morris Minor.

Objectives

Objectives of the Club include:

Activities

At monthly meetings you can meet like-minded enthusiasts, swap stories and find out about local and national events. There is also a quarterly magazine for Morris Minor owners and ad-hoc flyers to let people know about events.

In previous years, events have included:

Original hand drawn illustrations of Morris Minors used on this website were created by Paul Bennett, Andy Lenton and Eve Marshall. All illustrations can be purchased online from the artists’ websites.

www.immoc.net

Filed Under: News with 0 Comments

An appointment to have your vehicle inspected must be made within 7 days of the vehicle entering the State in order to register and pay the VRT (and any other tax liabilities due on the vehicle). You must then complete the registration process within 30 days of arriving in the State.

An appointment for one of the designated NCT centres can be made through one of the following methods:

– On-line for VRT bookings ONLY

– Phone: 1890 927 787

– Post: Vehicle Registration Tax Inspection, 3026 Lakedrive, Citywest Business Campus, Naas Road, Dublin 24

Confirmation of your appointment will then be sent to you either by SMS, e-mail or by post. Please ensure you have carry proof of your confirmed appointment with you when using your vehicle until the registration process is completed and the registration number is displayed on the vehicle.

Remember:

If you cancel or rearrange this confirmed appointment within five working days (Monday- Friday) of the test date (not including the day of the test), or fail to show up for the test, a €28.29 (inclusive of VAT) surcharge will be applied when the vehicle is next brought for testing.

Any queries relating to the cancellation fee may be made in writing to the Vehicle Registration Tax Inspection, Lakedrive 3026, Citywest Business Campus, Naas Road, Dublin 24.

Please be advised that if you do not complete your registration process within the 30 day period then an additional assessment of VRT maybe raised for the period the vehicle remained unregistered in the State. In this regard, you are advised to retain possession of the documentation relating to the shipping or storage of the vehicle where the date of the invoice is more than 30 days earlier than the date of registration. It should be noted that an unregistered vehicle may be detained or seized by Revenue Officials or by An Garda Siochana.

A directional map to the centre can be viewed by clicking on the centre name below:

– Arklow

– Blarney

– Carlow

– Dundalk

– Ennis

– Enniscorthy

– Galway

– Greenhills

– Kells

– Kilkenny

– Letterkenny

– Limerick

– Monaghan

– Naas

– Nenagh

– Northpoint

– Skibbereen

– Sligo

– Tralee

– Tullamore

– Waterford

– Westport

You must also be able to locate the chassis number for the vehicle inspector when presenting the vehicle for inspection.

Your vehicle will fall under one of the following categories:

A) New Vehicle

B) Used Vehicle

New Vehicle:

1) Please print and fill out the following Declaration Form for the Registration of a new Vehicle/ Motorcycle

2) EU Whole Vehicle Type-Approval Certificate of Conformity or IVA NASSTA Certificate of Conformity (CoC) – where applicable, please provide an English translation of this document. (This document will be retained by NCTS so please ensure you make a copy of it before you go to the test centre)

3) Invoice which must have the date of purchase/sale clearly indicated

4) Documentation verifying the new registered owner’s name and address (Utility Bill, Bank Statement, please note original documentation will only be accepted and must be no older than 6 months)

5) Personal Public Service (PPS) Number of the person in whose name the vehicle shall be registered to (Official documentation will only be accepted i.e Social Services Card, P60)

6) For vehicles imported from Northern Ireland, where the invoice is dated more that 30 days earlier than the date the vehicle is presented for registration, details of where the vehicle was stored. For vehicles purchased in the EU, we require shipping details to confirm the date of arrival of the vehicle in the state. For vehicles outside the EU, we require the single administrative number and the date it was issued by customs at the point of entry to the EU.

7) Where an exemption from VRT is claimed, the exemption certificate issued by Revenue

For TAN holders:

A).Where an authorised trader (TAN Holder), is registering a vehicle on behalf of a customer, he/she can now provide his/her own Revenue Customer Number or VAT number on company headed paper in place of the PPSN of the person in whose name the vehicle is being registered. The dealer must however, bring a photo copy of the customer’s utility bill along with a signed letter from the customer authorising that the vehicle can be registered in their name.

B)The person presenting the vehicle will be asked to produce either their original drivers licence or their passport along with a copy of the birth certificate or the original Certificate of Conformity in the case of a new vehicle.

C) You bring your completed Declaration for Registration of a new/ used vehicle form

D) You are no longer required to bring an invoice

E) The VAT number should be provided on company headed paper.

All documents above are compulsory and the vehicle will not be registered unless they are all presented with the vehicle at registration.

Used Vehicle:

1) Please print and fill out the following Declaration Form for the Registration of a used Vehicle/ Motorcycle

2) Evidence of previous registration e.g. foreign certificate of registration, a certificate of permanent exportation or a certificate of de-registration, as appropriate (this document will be retained by NCTS so please ensure you make a copy of it before you go to the test centre).

3) Invoice which must have the date of purchase/sale clearly indicated

4) Documentation verifying the new registered owner’s name and address (Utility Bill, Bank Statement, please note original documentation will only be acceptedand must be no older than 6 months)

5) Personal Public Service (PPS) Number of the person in whose name the vehicle shall be registered to (Official documentation will only be accepted i.e Social Services Card, P60)

6) For vehicles imported from Northern Ireland, where the invoice is dated more that 30 days earlier than the date the vehicle is presented for registration, details of where the vehicle was stored. For vehicles purchased in the EU, we require shipping details to confirm the date of arrival of the vehicle in the state. For vehicles outside the EU, we require the single administrative number and the date it was issued by customs at the point of entry to the EU.

7) Where an exemption from VRT is claimed, the exemption notification letter issued by Revenue.

8) Documentation (as approved by the Revenue Commissioners) confirming the level of CO2 emissions of the vehicle at the time of manufacture (if this information is not on the foreign certificate of registration). Where evidence of the level of CO2 emissions of the vehicle at the time of manufacture is not available at registration VRT will be charged at the highest rate applicable.

9) For vehicles over 4 years old, an unexpired roadworthiness certificate confirming that an equivalent to the NCT test has been passed. The vehicle will be called for a roadworthiness test (NCT) shortly after registration.

For TAN holders:

A).Where an authorised trader (TAN Holder), is registering a vehicle on behalf of a customer, he/she can now provide his/her own Revenue Customer Number or VAT number on company headed paper in place of the PPSN of the person in whose name the vehicle is being registered. The dealer must however, bring a photo copy of the customer’s utility bill along with a signed letter from the customer authorising that the vehicle can be registered in their name.

B)The person presenting the vehicle will be asked to produce either their original drivers licence or their passport along with a copy of the birth certificate or the original Certificate of Conformity in the case of a new vehicle.

C) For used vehicles, you must provide evidence of previous registration e.g. foreign certificate of registration (please bring an English translation of this document and also note it will be retained by the test centre so ensure you keep a copy of it).

D)You bring your completed Declaration for Registration of a new/ used vehicle form

All documents above are compulsory and the vehicle will not be registered unless they are all presented with the vehicle at registration.

When it has been established that the vehicle is eligible for registration you will be presented with a document containing the vehicle details which you will be asked to sign confirming that you wish to register the vehicle as outlined on the declaration. Following confirmation, Revenue will assign a registration number to the vehicle and this will be issued to you by the NCTS on payment of the tax due.

Please note that a second visit to an NCT centre as a result of incorrect or missing documentation will be at your own expense.

– Bank Draft (made payable to Applus Car Testing Service Ltd)

– Cash (Up to a limit of €200)

– Laser Card (Up to a limit of €1,500)

– Credit Card

– Company cheque with TAN numbers only (to a limit of €10,000 payable to Applus Car Testing Service Ltd)

Therefore, having paid the amount demanded, you can appeal the charge with Revenue under the formal excise appeal procedure details which are set out in a separate information leaflet VRT 6 – Appeal Procedures relating to Vehicle Registration Tax which you can obtain at www.revenue.ie or any Revenue Office. Details of these offices may be found on the www.revenue.ie

If you decide that you do not wish to register the vehicle, and pay the VRT due, you must ensure that the vehicle is taken out of the State immediately, but at the latest within 30 days of its initial entry into the State.

When you are applying for motor tax on a new vehicle or motor cycle, you must present the following document (RF 100) and appropriate fee at your local Motor Taxation Office RF 100 Motor Tax Application for a new vehicle

RF 100 Motor Tax Application for a new motor cycle

– Transfer of Residence

– Transfer of Business Activity

– Inheritance

– Diplomatic

Relief is also available for certain persons with disabilities who meet specified medical criteria. An information leaflet VRT 7 – Vehicles for People with Disabilities – Tax Relief Scheme is available from www.revenue.ie or any Revenue Office.

If you think you are entitled to an exemption, you must first contact your local Revenue Office (see contact details at www.revenue.ie) and apply for the exemption. The application accompanied by the relevant documentation (see manual) will normally be processed within 10 working days and if approved, a letter confirming eligibility to the exemption will be issued to you. You must bring this letter to the NCT Centre when registering the vehicle to avail of the exemption.

An exemption will only be allowed on presentation of this letter at the NCT centre. Where the exemption letter is not available at the time of registration (e.g. lost or misplaced) full VRT will be charged. This will be refunded on presentation of the letter to a Revenue office.

RF 100 Motor Tax Application for a new vehicle

RF 100 Motor Tax Application for a new motor cycle

For vehicles presented with a VRD and the Vehicle Category (J on the VRD doc) states N1 it will return a price based on a category B class. If you have a query on this and feel that the vehicle should be a category C class, then please produce the following information:

– The Mass in Service Weight (this can be obtained from the VIN plate on the vehicle)

– The Gross Vehicle Weight (this can be found in the handbook of the vehicle or can also be present on the VRD under F1 – Max Permissible Mass).

If you cannot obtain this information then please get this from either from a weight bridge or main dealer.

If you still are not happy with the fee returned then you can pay and appeal the fee through Revenue.

Where a vehicle is being presented with the Vehicle Category as M1 but a conversion to commercial vehicle has been carried out and you wish it t be classed as an N1 then you must have the following two documents completed:

Declaration of Conversion by Vehicle Owner

Template declaration from a Suitably Qualified Person (SQI)

A SQI is a person who has an Engineering/Technical Qualification level 7 or higher or appropriate accreditation with Engineers Ireland or the Institute of Automotive Engineer Assessors). The declaration must be drawn up on the headed paper of the SQI, which must contain, as a minimum, the Name and/or Business Name, address, contact details and Revenue number of the SQI.

If you wish to avail of this service then please contact our VRT booking line on 1890 927 787 and ensure you have the following information in front of you:

• Company Name

• Address,

• TAN Number

• Contact Number

• Number of vehicles for pre-inspection.

In addition to the documents mentioned in question 3 above the following documents are also required.

A) The person must bring company headed paper that has the company name and address together with the registered company number on it.

B) On the headed paper a note stating that the Company secretary is allowing this vehicle to be registered into the company name, if the vehicle is not being registered by the secretary then they also need to state on this headed paper that they give this person (must be named on the statement) authorisation to register this vehicle (VIN Number must be noted on the company headed paper) in the company’s name.

C) If the company has a vat number then this also needs to be noted on the company headed paper.

Filed Under: News with 0 Comments

WE HAVE OUR NEXT CLUB MEETING THIS THURSDAY 30th in JENKINSTOWN WOOD JUST OFF THE CASTLECOMER ROAD FROM 8 ON, BRING OUT YOUR PRIDE

AND JOY AND MAYBE THE WIFE ASWELL

SEE YA THERE

Filed Under: News with 0 Comments

|

As the first multi-purpose car, this was a revolution. It took some back-to-front thinking to get there, though, starting with putting the motor up front. This made it possible to morph from family sedan to utility van in one flick of the fold-away seats. Even the flip-up boot door was a world first, copied by every carmaker since. Talk about “driving the change”!

The second revolution was the price. Dreyfus wanted to make this the French car anyone could afford, so he told his designers it should cost the customer “350,000 francs and not a cent more” (or roughly $50 in 1961 money). Office wags called it “Project 350”.

So what happens when the boss crashes the prototype? You say nothing. The hapless test-driver-turned-passenger, Louis Buty, was injured, but to protect the secrecy of the tests, and keep spying competitors off the scent, they invented a story about a car accident. Of course there were rumours. Something to do with a girl… Once the car was an established success, Dreyfus came clean with the real story.

Clearly, it’s what’s inside that counts. Because our heroine went on to win the hearts of countless admirers, selling more than 8 million in 100 countries around the world. Today, collectors go wild over a rare model of Renault 4, especially if it’s an early one. Jean-François Préveraud considers himself the luckiest Renault 4 collector on earth. He owns a car with plaque number 191, the earliest known example. As he says: “She’s spotted with rust, undriveable and really doesn’t look great. But she’s the most beautiful piece in my collection.”

Taking his hard-earned retirement in December 2010, he spent the last 18 years lavishing attentions on Renault’s own vehicle collection. His final labour of love was helping prepare many of the show-stopper Renault 4s for their 50th birthday bash. “The younger mechanics know I worked on the original assembly line, so they’re always asking ‘how does this piece go on’ or ‘where does this go’. I find it very touching.”

Coming soon: the Renault 4 goes racing…